The Progressive Income Tax: A Tale of Three Brothers

"The Progressive Income Tax" is one of those economic terms that gets bandied about, but few actually know what it means or how it works. This tale of three ...

PragerU

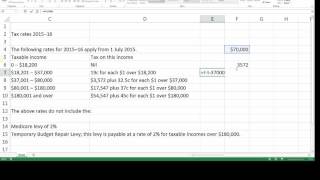

Tax system in Australia | Things you should know | Individual Tax slabs or brackets in Australia

My Youtube Channels Technical Channel - https://www.youtube.com/channel/UCoSpmr2KNOxjwE_B9ynUmig Food Channel ...

Sagar Lifestyle and Reviews

High Tax VS Low Tax Countries

We compare three different countries/regions with different tax policies and figure out which is the best. The UK can be considered a reasonably high tax country, ...

The Business Shifu

Flag Theory: The worlds four tax systems explained

Link to the article: https://globalisationguide.org/worlds-taxation-systems-explained/ Follow us on Instagram: https://instagram.com/globalizationguide There are ...

Globalization Guide

Tax Return for Overseas Students in Australia | Australian Taxes

Doing Taxes are never fun. But everyone working in Australia and earning more than $18200 must file their taxes every year, regardless of their visa status.

Overseas Students Australia

Simple explanation of tax in Australia by a tax agent

Ever wondered how to work out your tax refund? Tax agent Romeo Caporaso of http://www.taxaccountingadelaide.com/online-tax gives you a fun lesson and ...

TaxAccountingAdelaid

How to prepare tax return Australia 2020 explained

This video is a tutorial on how to prepare tax returns in Australia by yourself. Preparing your tax return online is easy and free service. This video will be helpful ...

StarTEK

Tax theory and tax systems - CPA Advanced Taxation Module 1 (2018 Semester 2)

CPA Advanced Tax has been rewritten. Our CPA support resources are being updated to align with the new content. Check out this clip that considers both tax ...

KnowledgEquity - Support for CPA

The Design of the Tax System

The Design of the Tax System lecture.

Jonathan Keisler, PhD

Australian Tax Made Easy Video 1

There are number of advanced strategies we can offer you at http://tmsfinancial.com.au/speak-expert www.tmsfinancial.com.au.

TMS Financial Services

How Sweden Balances High Taxes And Growth

Taxes are a big political issue the United States. Progressive Democrats like Alexandria Ocasio-Cortez have proposed higher taxes on wealthy Americans to ...

CNBC

The four tax systems in the world explained!

These are three types of taxation you will find all over the world ( Territorial-based, Residence-based, and Citizenship-based) and then there are countries with ...

Kiavash Zare

Three types of tax in the world explained

What is the difference between citizenship-based taxation, residential and territorial taxation? Let's take a moment to talk about #NomadCapitalist101 facts.

Nomad Capitalist

Complete Guide on Lodge 2019/20 Individual Tax Return Australia MyGov

IMPORTANT NOTICE: You can use a shortcut method to increase your deduction if you worked from home due to COVID19 in 2020FY. The formula: No. of ...

Kaiwen Yang

Countries with Zero Foreign Income Tax

https://nomadcapitalist.com/2015/09/07/tax-free-countries-second-residency/ Did you know you don't need to live in a zero tax country like Monaco or the UAE to ...

Nomad Capitalist

Corporate tax in 5 1/2 minutes

To build a robust and productive conversation about tax, it can be helpful to start with some reflection on how taxes have come into our societies in the first place.

KPMG

How to Calculate PAYG Tax in Australia - Tax Withheld

Understand the basic concept of PAYG tax withheld in Australia. Useful for employees, individuals to understanding their tax obligation.

Applied Education

CANADIAN TAXES (For Immigrants)

Do you know anything about Canadian taxes? Visit my website: http://metv.cool If you love my lessons, you could buy me a coffee!

Mad English TV

Tax design and tax mix - CPA Advanced Taxation Module 1 (2018 Semester 2)

CPA Advanced Tax has been rewritten. Our CPA support resources are being updated to align with the new content. Check out this clip that considers both tax ...

KnowledgEquity - Support for CPA

How to Pay NO TAX: Become a Big Company in Australia

The latest corporate tax transparency data released by the Australian Taxation Office this week shows that around one-third of large companies operating in ...

Daily Rant Australia

Chris Evans: Simplifying Australia's Personal Tax System - Knowledge@ASB

To read a transcript of this interview please visit the Knowledge Today blog - http://blogs.unsw.edu.au/knowledgetoday/blog/2012/05/personal-tax-simplifie/ As ...

AboutUNSW

How tax brackets actually work

There is a common misunderstanding about how tax brackets work in the US, and it's causing us to have uninformed debates about taxes. Become a member of ...

Vox

Taxes 101 (Tax Basics 1/3)

In this video, you'll learn everything you need to know about the U.S. Tax system. We cover the ins & outs of how taxes are calculated, everything from ...

MoneyCoach

This 'Australia Tax' bullshit explained!!!

What is the 'Australia Tax' and the impact to gamers?

DasTactic

Overview of payroll tax in Western Australia

This video will provide a brief overview of the new payroll tax diminishing threshold in Western Australia. For more information about payroll tax, see our Payroll ...

DeptFinanceWA

TAX,ABN Cómo declarar los impuestos en AUSTRALIA // Queremos Viajar// Estudiantes en el exterior//

Aclaramos muchas dudas respecto a la declaración de los impuestos para los estudiantes internacionales en Australia Links importantes: ATO ...

Queremos Viajar

TAX SYSTEM IN AUSTRALIA

HOW MUCH TAX DOES GOVERNMENT PAYS.

Indians In Australia

How is Tax Calculated in Australia for those Aussie Expats Who Qualify as a Non Resident

For those Australian expats who qualify as a non-resident for tax purposes, the rate of tax that you will pay in Australia to the ATO will vary according to the ...

Atlas Wealth Management

Know CFC Rules if you want to Live Tax-Free

https://nomadcapitalist.com/2019/04/26/cfc-rules/ Most western countries know have what is called “CFC rules” that prevent you from spending too long in one ...

Nomad Capitalist

Pascal Saint-Amans, OECD tax policy head, on global tax system reform

The head of the OECD Centre for Tax Policy and Administration speaks to INSEAD Knowledge about how countries are coming together in an effort to create "a ...

INSEAD

How to do a Tax Return as an International Student in Australia

Did you earn money in Australia? Chances are you need to do a tax return! For more information, check out: ...

Insider Guides - International Student Guides

Tax Saving Tip Australia - Super Contribution

TAX SAVING TIPS - It's that time of year again and to help you save tax we have a number of tax saving tips. In this video, Mark shares how to save tax while ...

Wardle Partners - Business Accountants & Advisors Sunshine Coast - Tax, Accounting, SMSF, Auditors Caloundra

Senator Day - Fixing Australia's Tax System

Senator Day addressed the Australian Senate chamber explaining how to fix the tax system by reducing taxes.

Family First Australia

Land Tax in Western Australia

A short overview of the key aspects of land tax in Western Australia. Find out more about land tax at WA.gov.au.

DeptFinanceWA

Filing Taxes as an American Living in Australia -- US Expat Taxes Explained

http://www.greenbacktaxservices.com/blog/us-expat-taxes-australia/ Moving to the Land Down Under? Learn how moving to Australia may affect your US expat ...

Greenback Expat Tax Services

How India’s GST compares to other countries’ tax systems

The Goods and Services Tax is scheduled to be launched at the midnight of June 30. The GST aims to simply the tax system in India but is rather complex when ...

VCC TV

Tax deductions in Australia | Rask Finance | [HD]

Here's a video explaining what items are tax deductible in Australia and what "tax deductible" means? In Australia, amongst other things, one rule is that the ...

Rask Australia

Tax costs and cuts divide Labor and Liberals | Nine News Australia

How taxes will be raised and spent is the where the battle lines are being drawn after the first week of the federal election campaign. Labor wants to cut tax ...

9 News Australia

Coalition attacks Labor with $387 billion tax claims | Nine News Australia

Deep into the first week of the election campaign and the fight is firmly about tax and health. The Coalition is attacking Labor over economic management this ...

9 News Australia

Concur Case Study: The Tax Institute, Australia

With Concur, data insights help The Tax Institute have greater visibility and control over its spend, plus manage costs proactively. See more customer success ...

SAP Concur

Payroll Tax in Australia

Sample from Applied Education Popular Payroll Administration in Australia course online or classroom.

Applied Education

Understanding Payroll Tax for businesses in Australia

http://www.empoweraa.com.au - ** Hit subscribe for regular small business tips from your local accountant. In my personal opinion, Payroll Tax is by far the most ...

Empower Accounting and Advisory